Will the Australian Property Market Continue to Rise Without an Official Rate-Cut Cycle? Historical Data and Current Entry Strategies Fully Explained

As Australia’s economy gradually stabilizes, the property market has become a focal point for both investors and homebuyers. The Reserve Bank of Australia (RBA) has recently signaled that inflation is under control, and the market widely anticipates a new rate-cut cycle to commence soon. Although official rate cuts have not yet begun, property prices have already shown an upward trend, prompting many to question if now is the right time to enter the market. This article will analyze the impact of rate cuts on property prices, affordability and accessibility issues, and provide strategies for making informed property decisions.

1. Rate Cuts and Property Prices – Lessons from Historical Data

Over the past two decades, the significant rise in Australian property prices has been closely linked to interest rate cycles. Let’s examine some key historical periods:

- 2001 Rate-Cut Boom

In 2001, the RBA reduced the official cash rate six times in succession (from 6% to 4.25%) without an economic recession. Coupled with reintroduced capital gains tax discounts, first-home buyer grants, and a surge in immigration, property prices rose from 3-4 times average income to 8-9 times.

According to data from the Australian Bureau of Statistics, national property prices increased by over 50% from 2001 to 2004. - Post-2008 Global Financial Crisis

In just three months during 2008, the RBA slashed rates five times, reducing the cash rate from 7.25% to 3%. Confidence returned, and property prices recorded double-digit growth in 2009-2010.

Historical data from RP Data shows Sydney property prices rose 13% in 2009 alone. - 2020 Pandemic Period

The RBA reduced the cash rate to 0.1% through three cuts in 2020. Between 2020 and 2022, national property prices rose by an average of 28%, with cities like Hobart seeing increases of over 40%. - Average Post-Rate-Cut Price Growth

Historical data from the past 10 rate-cut cycles reveals that property prices rose by an average of 15%-20% within the first two years. Extreme cases, such as the early 1990s (when cash rates dropped from 18% to 7.5%), saw property prices surge by 60% over two years.

2. Current Market Conditions and Development Expectations

1. Property Prices Already Reflect Rate-Cut Expectations

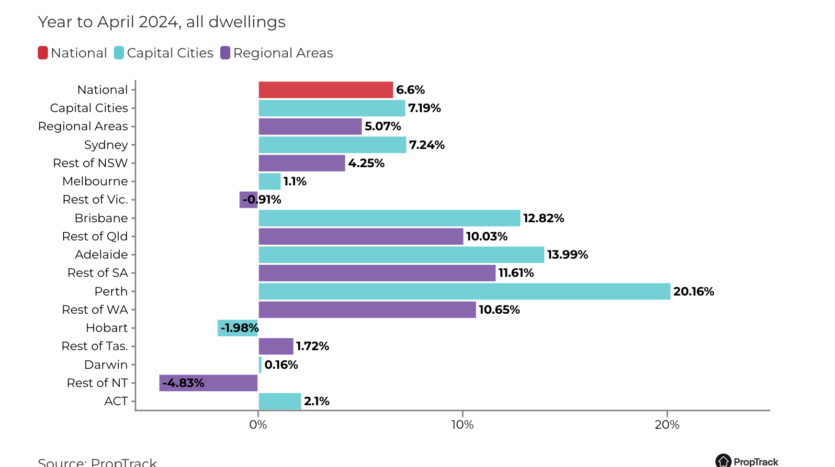

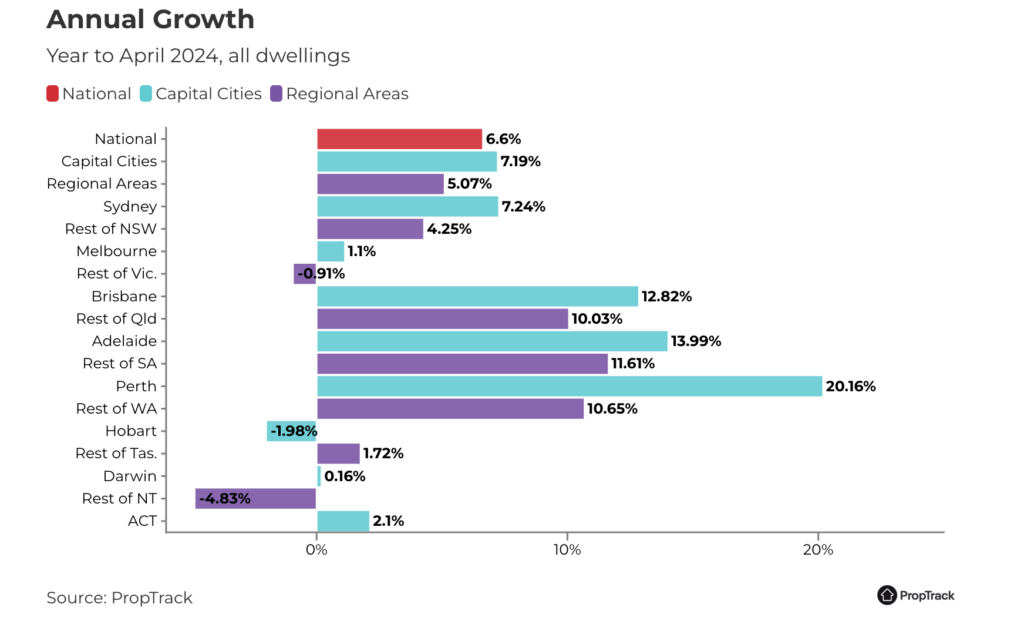

Even before official rate cuts, national property prices rose by approximately 6.6% from April 2023 to April 2024. Over the last three months alone, prices increased by 1.4%, significantly outpacing income growth of 0.9%. This indicates that the market has already factored in rate-cut expectations, with some buyers and investors entering early to capitalize on the initial wave of growth.

2. Affordability Improves, But Accessibility Declines

- Affordability: Lower interest rates ease mortgage repayment pressures, improving affordability for buyers.

- Accessibility: The challenge of saving for a deposit continues to grow. On average, Australian households now require over 12 years to save a 20% deposit, compared to 6 years in 2001. Moreover, the percentage of homeowners aged 25-29 has dropped from 43% in 2001 to 36% today.

3. Supply Shortages and Policy Constraints

- Delayed supply growth: Despite government initiatives to boost housing supply, the lengthy construction process means it will take time to meet rising demand.

- Demand-driven policies: Historically, factors like rate cuts, capital gains tax discounts, first-home buyer grants, and immigration have driven property prices. While current policies focus on increasing supply, short-term effects remain limited.

3. Rate-Cut Cycles and Entry Timing – Key Takeaways

Historical Insight: Early Entry Offers Maximum Potential

Historical data shows that buyers entering the market at the start of rate-cut cycles often see the highest returns. For instance, during the early stages of the 2001 and 2008 rate-cut cycles, property prices rose by an average of 20% over two years. Conversely, returns diminish significantly for late entrants when prices have already peaked.

Market Psychology and Future Trends

While some buyers have already entered the market in anticipation of rate cuts, an official announcement by the RBA could trigger a wave of activity from those currently on the sidelines. This influx of demand could sustain the upward momentum in property prices. For those who have already saved a deposit and have ample financial resources, entering the market now would be considered an "early-stage" move, offering the potential to secure future appreciation.

Risk Advisory: Plan Carefully

While rate cuts are beneficial for the property market, unforeseen changes in global or local economic conditions (e.g., slower rate cuts or inflationary pressures) could impact price growth. Buyers are advised to plan prudently, maintain financial reserves, and avoid excessive leverage.

4. Expert Advice – Three Key Entry Strategies

- Evaluate Financial Stability

Set a realistic budget for your purchase, ensuring sufficient emergency funds are in place. Avoid overextending financially in pursuit of rapid gains. - Focus on Location and Quality

Premium locations and rare, high-quality properties tend to see higher appreciation during property booms, offering better long-term potential. - Act Early, Stay Flexible

If you’ve identified a suitable property, entering the market early can position you to benefit from rate-cut-driven growth. Stay adaptable to changes in policy or economic conditions.

Over the past few decades, Australian property price growth has closely mirrored rate-cut cycles. While the current market has yet to officially see rate cuts, prices have already begun reflecting expectations, and growth is likely to continue as rate cuts materialize. Historical data suggests that entering the market early in a rate-cut cycle offers the greatest potential for appreciation. For buyers with sufficient financial preparation, now may be an opportune time to act. However, prudent financial planning and selecting properties with strong growth potential are essential for balancing opportunities with risk.

Register now for the Smart Investment Seminar on June 14, 2025, to devise your investment strategy ahead of time:

- Date: Saturday, June 14, 2025

- Time: 12:30 PM

- Venue: 21/F, 64 Connaught Road Central, Hong Kong (MTR Hong Kong Station Exit E / Sheung Wan Station Exit E5)