UK Property Market Outlook: Corporate Giants Drive Economic Surge, Dual Gains in Prices and Rental Yields

As the global economic environment continues to change, the UK real estate market, backed by a robust economic foundation and international capital interest, continues to show strong appeal. In 2024, with Microsoft announcing its largest-ever investment of £22 billion, the UK has not only become a hub for technological innovation but also reignited the property market. Homes Global offers an in-depth analysis of the latest trends in the UK economy and property market dynamics, helping you expand your overseas asset portfolio.

UK Economy Stabilizing, Boosting Overseas Investor Confidence

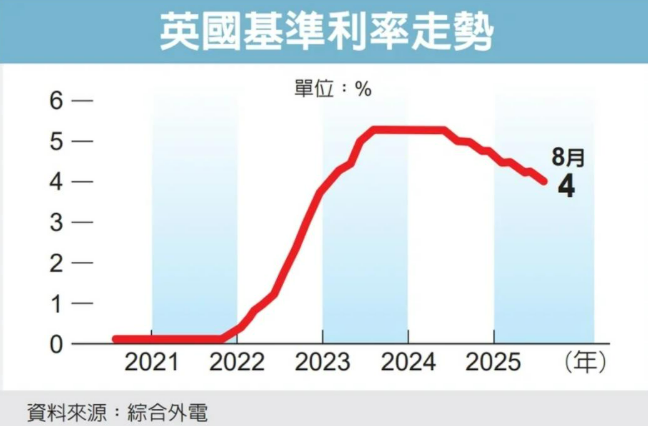

According to the latest data from the Office for National Statistics (ONS) in August 2024, the UK’s annual inflation rate has stabilized at 3.8%. Although this is above the Bank of England's target of 2%, it reflects a stable trend. Rising food prices have boosted consumer spending, indicating that the domestic market remains vibrant. To address the pressure of living costs, the Bank of England has lowered interest rates five times since last year, bringing the base rate down to 4%. This has effectively released liquidity into the market, providing a positive stimulus for the real estate sector.

The Chancellor of the Exchequer emphasized that the government will continue to promote tax reductions and increase social welfare, with a new round of tax and spending policies expected to be announced in November to further support families and businesses. These policies provide property investors with a more stable economic outlook and cash flow environment.

Microsoft’s £22 Billion Investment Sets New Record for International Capital

In July 2024, Microsoft announced a significant investment of £22 billion in the UK, focusing on AI, data centers, and technology infrastructure, solidifying the UK's position as a leader in European technological innovation. This move not only attracts a flow of tech talent but also drives housing demand from high-income groups, further consolidating the UK’s status as a preferred destination for global capital.

In addition to Microsoft, tech giants like Google and OpenAI are also increasing their investments, driving the development of innovation ecosystems in major cities such as London, Manchester, and Newcastle. The influx of foreign capital directly boosts local infrastructure, education, healthcare, and living amenities, propelling long-term growth in the property market.

Three Highlights of the UK Property Market: Steady Price Increases, Attractive Rental Yields, and Strong High-End Housing Market

1. Steady Price Increases with Market Resilience As of July 2024, the average house price in the UK has increased by 2.8% year-on-year, reaching £270,000. England, Wales, Scotland, and Northern Ireland all recorded positive growth, with core cities like London and Manchester showing particularly strong increases. Market analysis suggests that as mortgage conditions improve and interest rates decrease, buyer demand will further be released, leading to increased transaction activity.

2. Rising Rents with Strong Cash Flow Returns The average rental growth rate in the UK private sector has reached 5.7% year-on-year, with the average monthly rent in England hitting £1,403. Wales and Scotland recorded annual increases of 7.8% and 3.5%, respectively. The high rental growth provides overseas investors with stable cash flow, making it particularly appealing for those seeking long-term, steady returns.

3. Record High Transactions in the Luxury Housing Market In July 2024, a luxury apartment in Manchester sold for £3.5 million, breaking local price records per square foot. The high-end housing market in the city is active, attracting high-net-worth individuals due to top-notch amenities, five-star services, and quality educational resources. Additionally, Manchester's high graduate retention rates and rapidly developing innovative industries continue to enhance local property values.