Why Has Australian Real Estate Become the "New Blue Ocean" for High-Net-Worth Individuals from Taiwan?

In the ever-changing geopolitical landscape, the pursuit of asset preservation and a high-quality living environment has become a consensus among Taiwan's high-net-worth individuals. Previously, regions like Japan and Malaysia in East Asia were hot spots for overseas property investment, but today, Australia, known for its political stability and quality education, has rapidly emerged as a global investment focus, with a significant increase in inquiries from Taiwan regarding property purchases.

Perfect Combination of Safety, Education, and Geographic Advantages

Australia's ability to stand out in the overseas real estate market can be attributed to three key advantages:

1. High Political and Safety Stability Australia boasts a mature and stable political environment, implementing strict gun control laws that provide vastly superior safety compared to many other countries. This creates a highly secure environment for both assets and family members.

2. World-Class Educational Environment For families that prioritize education for their children, Australia has more world-ranked universities than Canada. This means that while seeking a quality learning environment for the next generation, you can also benefit from the rental income generated from real estate investments.

3. Convenient Management With a time difference of approximately two hours and a travel time of only 8 to 9 hours from Taiwan, managing property, visiting family, or ensuring children's education is much more convenient and efficient compared to the United States and other countries.

Transparent Market and Stable Investment Returns

The Australian government has strict regulations on the real estate market, ensuring healthy market development and effectively reducing risks associated with overseas investments. Real estate prices and rental information are highly transparent, akin to a real-price registration system. Brokers base their pricing on market assessment reports, strictly avoiding malicious speculation and excessive pricing to maintain market stability.

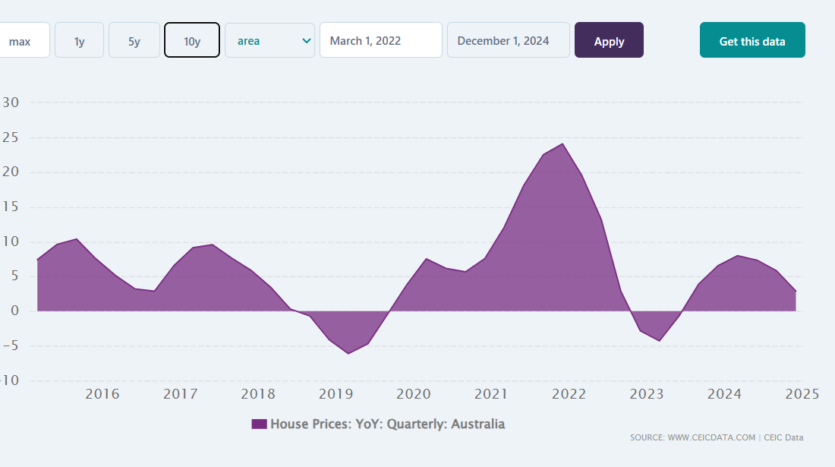

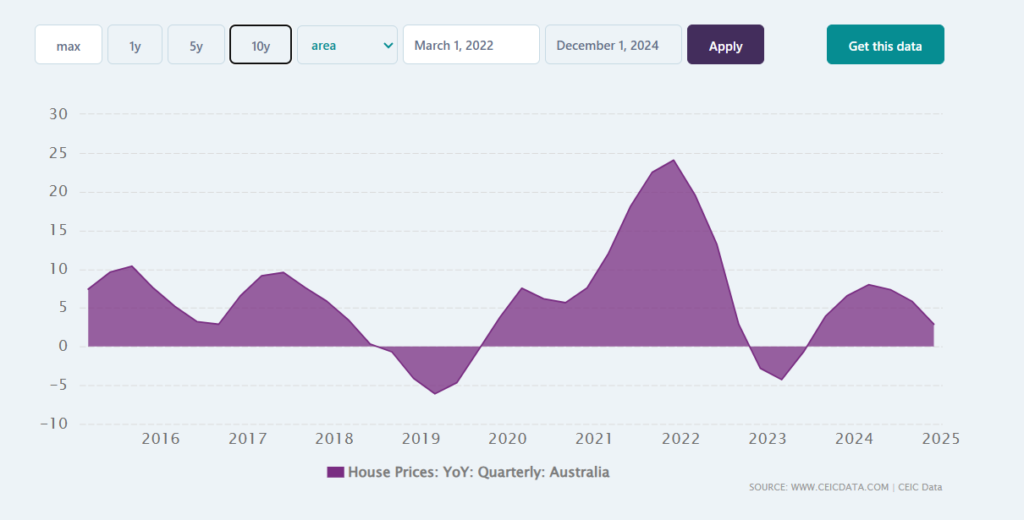

In terms of investment returns, the Australian real estate market has shown robust and stable growth over the past decade, with average prices increasing steadily by 5% to 8% per year, providing investors with predictable long-term returns. Additionally, compared to other popular immigrant countries, Australia's tax system for foreigners is more favorable in many aspects, further enhancing investment attractiveness.

Key Points for Overseas Buyers: Transaction Systems and Safety Regulations

To protect the residential rights of local inhabitants, Australia has strict regulations for overseas buyers, ensuring transaction safety. In terms of purchase restrictions, overseas buyers without Australian citizenship can only buy off-the-plan properties or new homes. This government policy aims to curb property speculation and encourage the development of new housing. Investors must be aware of this.

Regarding transaction safety, property transactions in Australia are highly secure. Both parties have independent lawyers, and the purchase funds are transferred into a government-supervised trust account, meaning funds will not go directly to the developer's account. This system significantly reduces the risk of disputes for overseas buyers and ensures investment security.

Effortless Landlord Experience in Australia: Our "One-Stop Cross-Border Service"

To allow Taiwan's high-net-worth individuals to easily manage property investments in Australia while remaining in Taiwan, our platform offers comprehensive "one-stop cross-border services." From initial property analysis, loan planning assistance, to dedicated inspections, handovers, furniture sourcing, and subsequent rental management, we handle everything. Our services even extend to educational consulting for children and family trust planning, allowing you to delegate the complexities of Australian property investment to our professional team and effortlessly achieve the stable investment goal of "Being in Taiwan, with assets in Australia."

Note: Besides Australia, global trends in property investment are also focusing on emerging Middle Eastern markets. For example, official developers in Abu Dhabi have extended their reach to the Taiwan market, launching flagship projects in core locations of international financial centers, indicating a diversified global asset allocation development.